colorado employer payroll tax calculator

You can quickly calculate paychecks for both salaried and hourly employees. Colorado Salary Paycheck Calculator.

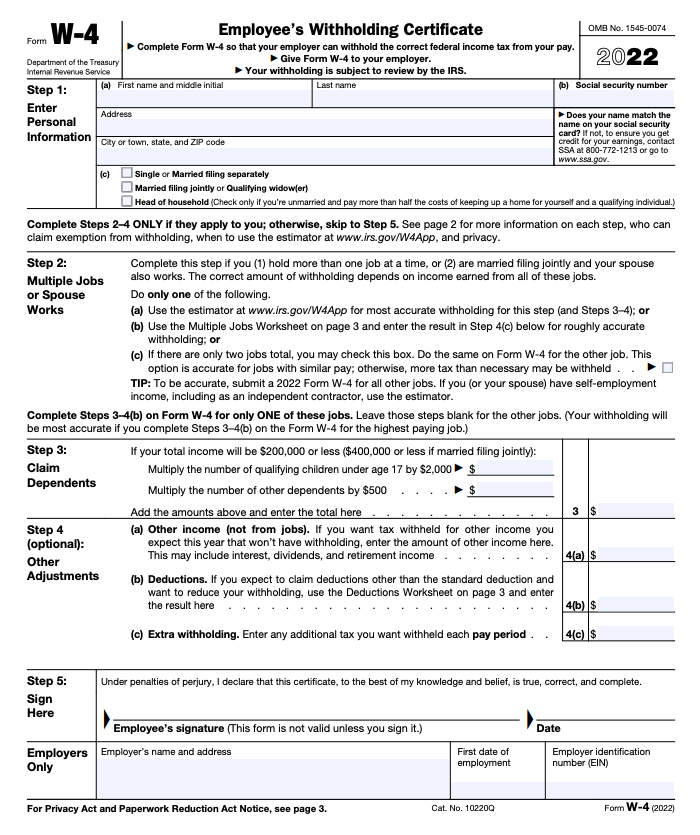

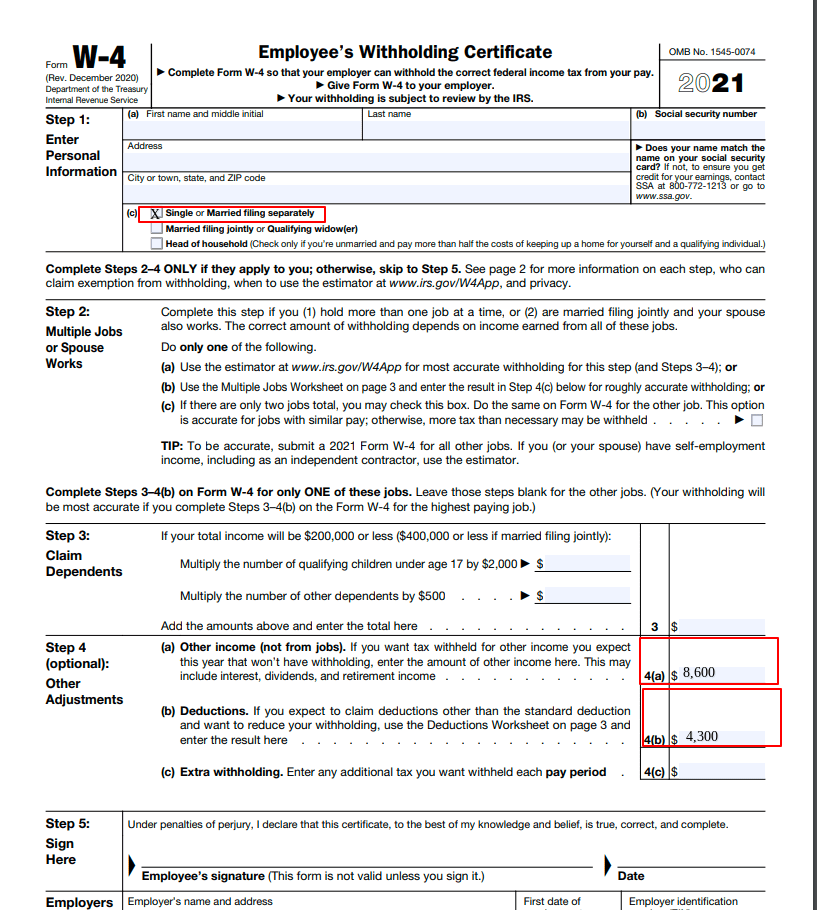

W 2 And W 4 What They Are And When To Use Them Bench Accounting

Colorado employer payroll tax calculator Wednesday March 9 2022 Edit.

. Based on the information you provide it. The Premiums Calculator may save you time and hassle and help ensure you pay the correct amount of unemployment insurance premiums. Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45.

How to Amend a Return. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Colorado residents only.

This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been utilized for numerous purposes. Denver 2021 Payroll Tax - 2021 Colorado State Payroll Taxes. This is a simple tool that provides emlploee NI and employers ni calculations withour the Employment Allowance factored in.

Insurers and self-insured employers pay a surcharge based on a percentage of premium or premium equivalents to the Colorado Division of Workers Compensation to offset the cost of administration of the Colorado workers compensation system and to fund the Major Medical and Subsequent Injury Funds. Colorado Hourly Paycheck Calculator. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator. Use this calculator for employees who are paid hourly. Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are applicable to the city of Colorado Springs in the state of Colorado.

Just enter in the required info below such as wage and W-4 information and our tool will perform the necessary calculations. We offer payroll deduction software that can help you calculate different types of payroll. Ad Compare This Years Top 5 Free Payroll Software.

The Colorado Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Colorado State Income Tax Rates and Thresholds in 2022. Surcharge is collected semiannually. Withhold 62 of each employees taxable wages until they earn gross pay of 142800 in a given calendar year.

Important Information About the 1099-NEC. Our paycheck calculator is a free on-line service and is available to everyone. Just enter your employees pay information and our calculator will handle the rest.

The maximum an employee will pay in 2021 is 885360. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Both employers and employees are responsible for payroll taxes.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Use ADPs Colorado Paycheck Calculator to calculate net take home pay for either hourly or salary employment. This Colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Filing Frequency Due Dates. Colorado Springs 2021 Payroll Tax - 2021 Colorado State Payroll Taxes. The new employer UI rate in Colorado for non-construction trades is 170.

As the employer you must also match your employees. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Get Started With ADP. Every employer must prepare a W-2 for. It is not a substitute for the advice of an accountant or other tax professional.

Details of the personal income tax rates used in the 2022 Colorado State Calculator are published below the. Colorado Employer Payroll Tax CalculatorFederal tax rates like income tax social security 62 each for both employer and employee and medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the irs. No personal information is collected.

How to Submit Withholding Statements. However you can also claim a tax credit of up to 54 a max of 378. How to Remit Income Tax Withholding.

Switch to Colorado hourly calculator. John has taxes withheld as detailed above and receives a net check of 79050. It simply refers to the Medicare and Social Security taxes employees and employers have to pay.

The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding. Colorado has a straightforward flat income tax rate of 455 as of 2021. The standard FUTA tax rate is 6 so your max contribution per employee could be 420.

Our paycheck calculator for employers makes the payroll process a breeze. Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are applicable to the city of Denver in the state of Colorado. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

A new employer in Colorado would have these additional payroll tax expenses. You pay John Smith 100000 gross wages. How to File Online.

We offer Payroll taxes software that can. How to Report Year-End Withholding Statements. Simply enter the calendar year your premium rate for the calendar year found on Your Unemployment Insurance Rate Notice Form UITR-7 and individual employee wage data.

Employers are required to file returns and remit tax on a quarterly monthly or weekly basis depending on the employers total annual Colorado wage withholding liability. Free Unbiased Reviews Top Picks. Discover ADP For Payroll Benefits Time Talent HR More.

Colorado Employer Payroll Tax Calculator calculator colorado employer payroll Edit It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees w4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and. Helpful Paycheck Calculator Info. Ad Process Payroll Faster Easier With ADP Payroll.

Common Payroll Tax Problems That Need To Tackle On Time Payroll Payroll Taxes Payroll Software

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Nanny Tax Payroll Calculator Gtm Payroll Services

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

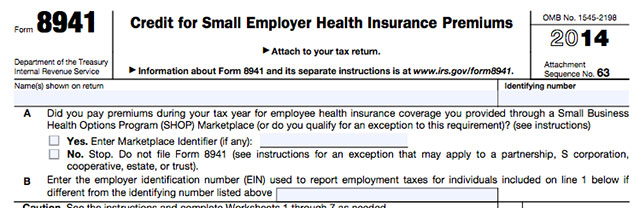

Employer Tax Credit Form 8941 And Instructions

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Employer Payroll Tax Calculator Incfile Com

2022 Federal State Payroll Tax Rates For Employers

How To Fill Out A W 4 Form Without Errors That Would Cost You Employee Tax Forms Math Models Proposal Writer

Tax And Payroll Services Business Tax Deductions Accounting Services Payroll

Employer Payroll Tax Calculator Incfile Com

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

Self Employment Tax Calculator For 2020 Good Money Sense Business Tax Deductions Business Tax Money Management Printables

Aaa Gas Cost Calculator Aaa Gas Prices Gas Prices Gas Disneyland Trip

Futa Tax Overview How It Works How To Calculate

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

What Is Local Income Tax Income Tax Income Tax

Free Colorado Payroll Calculator 2022 Co Tax Rates Onpay

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age